Insurance is complex, and understandably so. Every risk category is unique and must be handled distinctly. A car claim, for instance, is very different from a fire claim, with each process varying across segments. Legal protection is no exception. Let’s dig into why.

Introducing Groupama, #1 in legal protection in France.

Groupama is the #1 insurance company for legal protection in France. They shared with us their secret recipe for better managing claims in legal protection.

Together, we streamlined the claims FNOL and the collection of documents. Thanks to our digital case solution, they help customers accurately describe their exact situations for the 200+ claims types that Groupama had identified. This allowed them to collect the necessary documents and hand off a complete case to legal experts, achieving a whopping 50% efficiency gain on simple cases.

Here are the 3 reasons they shared on why legal protection is so different from other branches when managing claims.

Reason #1: The case has often been active for a long time.

The legal protection branch is very different from other branches. When the customer contacts the insurance company, they have often taken many steps to resolve their case, such as sending emails, receiving letters, and requesting official reports. This is very different from a car crash against a tree that happened just three minutes before the customer calls the call center.

.png?width=982&height=552&name=2024.05%20-%20Groupama%2c%20MegDigital%20%26%20Penbox.pdf%20(6).png)

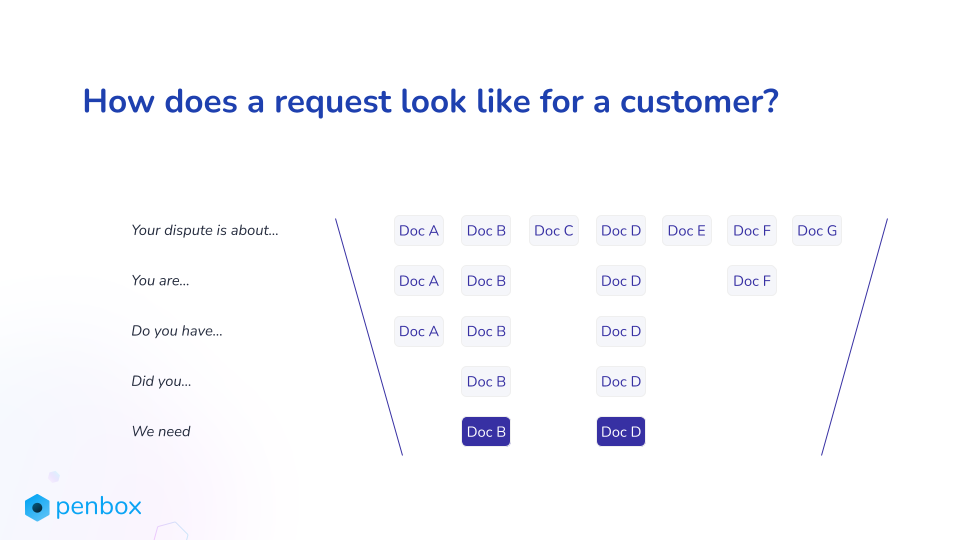

As a consequence, it takes a long time for the handler to understand the case. Let's take the example of an employee's recourse against their employer. When opening a case, handlers ask these types of questions:

- What is your dispute about?

- Is your employer in the public or private sector? If in the public sector, what is your employment type?

- Was the court involved in the dispute?

- When did the dispute arise? Did you contact your employer? Did you receive a reply?

- …

For each question, the handler collects complementary information. The process is cumbersome over the phone. After this, the handler must write a follow-up email to summarize the situation and request the relevant documents.

💡 Pro-tip: Pro-tip: If you are looking to digitize your legal protection claims process, make sure you can build advanced conditional logic into your forms. The more autonomous the business, the better, as you should expect some fine-tuning for each case..

During the first 12 months of use, Groupama iterated on its most frequent use case more than 14 times.

Reason #2: Customers need to provide a lot of documents and are confused about why.

The first step an insurance company takes in managing a claim is to check coverage. This determines if the case is eligible for support. An insured person usually assumes their claim is covered. They want a quick resolution, especially if the case has been ongoing for a long time. Legal protection is often seen as a last resort.

Explaining the case in detail, collecting all necessary documents, and sharing them through multiple emails was the #1 frustration reported by Groupama’s customers during focus groups. The back-and-forth of emails between front-office employees and customers, before the case was handed over to a legal expert, contributed to a poor customer experience. On average, customers exchanged more than 12 emails with the front office.

ℹ️ By introducing a smart form that allows customers to explain their cases, Groupama achieved impressive results. Customers gained a clearer understanding of why they needed to provide certain documents and were more willing to do so. As a result, complaints about document sharing dropped from being the #1 issue to zero reported complaints.

Reason #3: Documents alone aren't enough. Enhance efficiency with insightful questions.

Let’s make it very clear how a legal expert has to handle a case the traditional way. By "traditional way," we mean the expert must go through the 10+ emails received from the customer, including attachments. The expert must then decipher each document and try to understand the context.

You can imagine that the legal expert only gains a clear understanding of the case after spending 20 minutes carefully investigating.

ℹ️ By asking customers questions about their case through an online form, Groupama was able to provide their legal experts with a clear summary of the situation.The form had both closed-ended and free-text questions. his cut the handling time of simple cases (which are the most common) by 50%.

Summary

If you're a rapid reader who skipped to this section, or if you simply want a summary of the three key learnings from implementing Penbox in Groupama's legal protection department, here they are:

-1.png?width=747&height=201&name=Group%202%20(3)-1.png)

- Legal protection cases last longer than other claims. Unlike car crashes or fire claims, they can take weeks or months. A user-friendly way for customers to explain their situation and provide the necessary documents is definitely something to look for.

- Collecting documents alone is not enough. To be truly efficient (up to 50% on simple cases), you need to collect answers to yes/no questions and some free-text questions. This helps the legal expert understand the case quickly and sometimes even complete the coverage check from the summary.

- You can collect 10 documents and have no complaints from customers: The myth that shorter forms are better is definitely debunked. What customers prioritize is the ability to provide all necessary information in one go to have their cases handled efficiently. By introducing digital case management, Groupama transformed their #1 issue into having 0 complaints.

What's even more impressive is that Groupama completed the entire project in under 6 months, digitalizing over 200 different use cases.

Curious about Groupama’s success in digitizing 200+ legal claims? Find out about the unique challenges they faced and the innovative solutions they used to digitalize their processes.

👉 Read the full article: How Groupama Digitized More Than 200 Claims’ Legal Processes in 6 Months