Today, documents serve as evidence in claims processes. With new AI models, it is now possible to rethink their usage. Let's explore how we can reimagine the claims process in the post-ChatGPT era.

The old-fashioned way of filing claims

Traditional claims processes are lengthy and declarative. Customers must complete extensive forms with dozens of questions. They spend between 3 to 10 minutes to file a claim. And then have to submit photos and supporting documents.

Even when the insurers digitized the process, the core experience remains unchanged. Now, with the new technologies like ChatGPT and other AI models, it is time to rethink the process.

Leveraging smartphone pictures as a starting point

We all have them in our pockets. When an accident occurs, people reach to their smartphones. And directly take pictures or screenshots. Think about a car crash, a flooded apartment, or a delayed flight.

In the last month, we held workshops with claims professionals from major insurers. The goal was to explore how we could reinvent the claims process, starting with those first pictures.

Introducing new information-extraction technologies

Traditionally, extracting information from documents involves Optical Character Recognition (OCR). You need to provide hundreds of training documents to build the model. Fine-tuning the model takes a long time. It can be days or weeks.

With new AI models trained on large datasets, you can now skip this step. You can extract data from documents and images by prompting your LLM-powered AI model.

Here are a few examples:

- What is the license plate that you see in this picture?

- Identify the type of claim from this picture: is it a car claim or property claim?

- What caused the damages in the property? Choose from the following list: water leakage, fire, etc.

See it in action here:

What once took many months can now be done in just a few minutes.

Going beyond and truly leveraging LLM

Extracting precise pieces of information is what we do with traditional OCR technologies. With new AI models, you can now interpret and summarize documents.

Consider the documents you need to collect at the start of a claim. And those required throughout the entire adjustment process.

Here are a few examples of how LLMs can be utilized:

- The current claim covers the repair of the swimming pool. Are there other costs listed in the quotation / invoice?

- Summarize the leakage detection report

- What damaged goods do you identify in the pictures?

Putting the pieces together

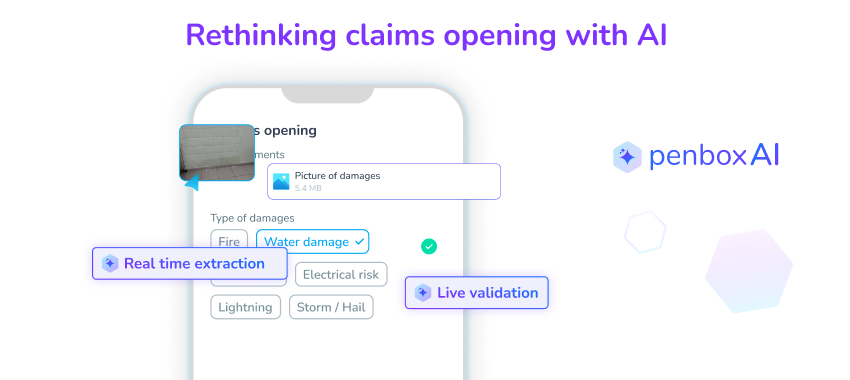

At Penbox, we've already done the groundwork. Using our studio, you can easily integrate AI extraction into your forms. This allows you to reuse information extracted in real-time and adapt the rest of your form.

Join the revolution

Are you an insurance company or distributor looking to bring true innovation to the market? Don't hesitate to reach out to our team of experts to discuss how we can bring your projects to life.